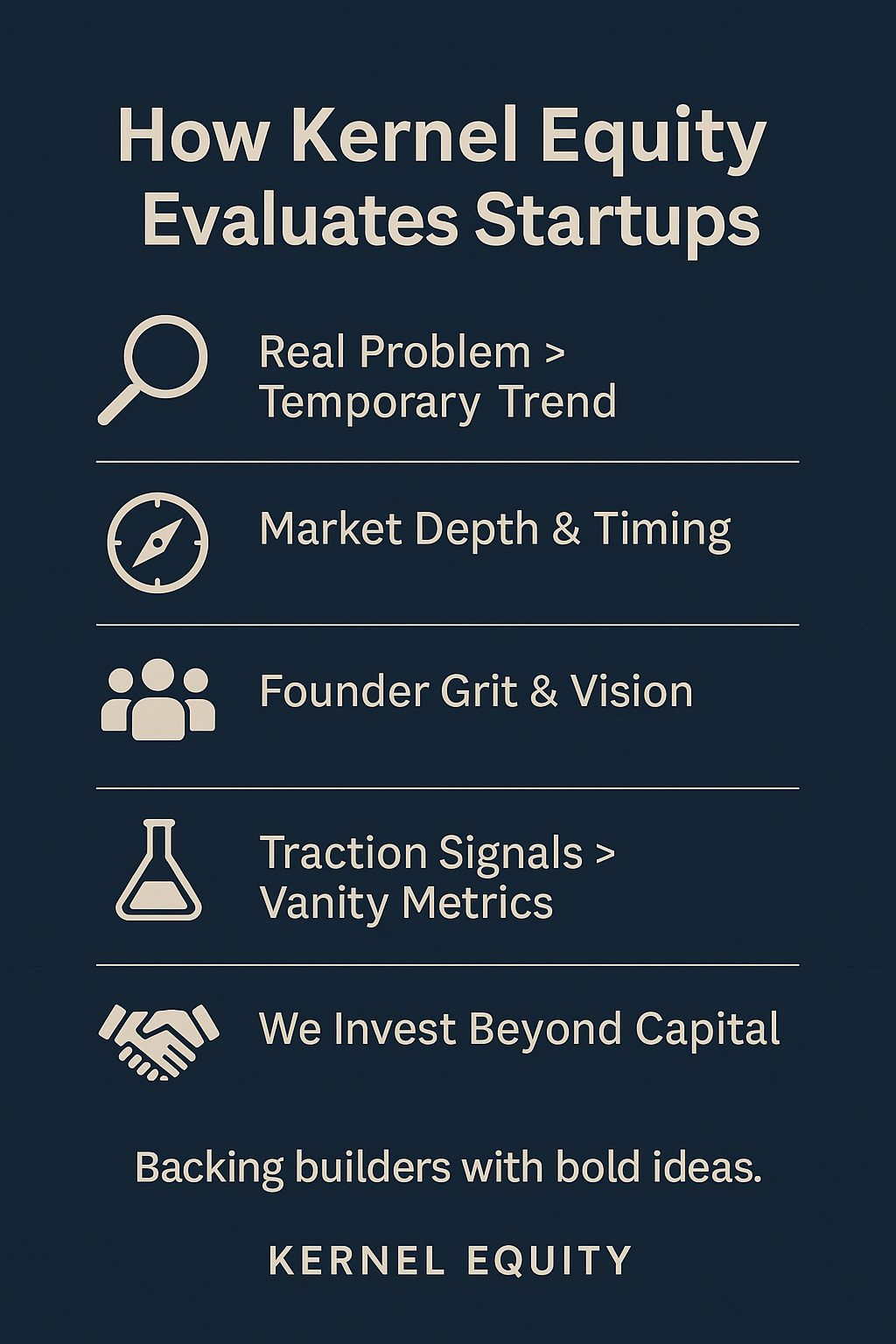

Inside Kernel: How We Evaluate Startups Before Investing

In venture capital, writing the check is just the beginning. At Kernel Equity, we believe great investing starts with deep curiosity, structured evaluation, and an unwavering belief in the potential of people. Every founder who pitches to us has a dream, but not every dream is venture-scale—and that distinction is what our investment process is designed to uncover.

The Problem-First Lens

We begin with a simple question:

What problem is this startup solving, and why does it matter?

If a startup isn’t addressing a real, urgent problem—or creating a significant opportunity that didn’t exist before—it’s unlikely to gain traction. We look for startups that can clearly articulate the “painkiller vs. vitamin” argument. In most cases, we lean toward painkillers.

But even painkillers need timing, and that’s where context comes in.

Market Timing and Depth

Some of the best ideas fail because the market isn’t ready. Others succeed wildly because they catch a wave just as it rises.

At Kernel, we ask:

-

Is this market growing or shrinking?

-

Are customer behaviors shifting in a way that supports this?

-

Will this be a $100M+ opportunity in the next 5–7 years?

We’re not just betting on a great product—we’re betting on the right product at the right time.

Founders Over Everything

We’ve backed products that changed. We’ve seen business models pivot. But we rarely regret backing strong founders.

We look for:

-

Clarity of thought and communication

-

Grit and adaptability

-

A clear sense of “why this, why now, why you?”

Founders who combine domain knowledge with the humility to learn are often the ones who build enduring companies. We don’t expect perfection—we expect progress.

Traction and Signals

Not every company we fund is post-revenue, but we do look for signals of velocity:

-

Early customer adoption

-

Iteration speed

-

Data-backed learning loops

-

A clear go-to-market plan

Traction tells us the market wants what you’re building. Momentum tells us you can deliver it consistently.

Fit With Kernel

Every VC firm has its own style. At Kernel Equity, we’re collaborative partners. We like rolling up our sleeves, being involved post-investment, and sharing our operator knowledge. We work best with founders who value that engagement.

We invest where we can add value—not just capital.

If you’re looking for silent money, we may not be the right partner.

If you’re looking for a long-term ally, we just might be.

Final Thoughts

Startups are unpredictable. But our evaluation process is designed to reduce avoidable risks while embracing calculated ones. At Kernel Equity, we’re not just betting on businesses—we’re backing builders.

If you’re building something bold, we’d love to hear from you.

Let’s build the future—together.

Be Social :

Categories

Archives

Recent Post

May 15, 2025

Inside Kernel: How We Evaluate Startups Before Investing

May 15, 2025

Inside Kernel: How We Evaluate Startups Before Investing

May 05, 2025

Fueling Innovation: Kernel Equity’s Venture Capital Vision

May 05, 2025

Fueling Innovation: Kernel Equity’s Venture Capital Vision

Feb 07, 2025

Lipscomb University launches LUInnovate, appoints first chief innovation officer

Feb 07, 2025

Lipscomb University launches LUInnovate, appoints first chief innovation officer

Nov 08, 2024

Kernel Equity Launches CLEarly Legal: A Revolutionary CLE-by-Podcast App

Nov 08, 2024

Kernel Equity Launches CLEarly Legal: A Revolutionary CLE-by-Podcast App